Connect with high-intent financial decision-makers

With millions turning to Quora for trusted financial advice and product recommendations, it’s an ideal platform for reaching consumers during critical financial decisions. Engage with users actively researching financial products, services, and investment opportunities.

Financial services industry trends

Modern consumers expect digital-first, personalized money management tools—and they are more financially conscious than ever, conducting extensive research before choosing financial products or services. This shift has transformed how people discover and evaluate banking and investment offerings, with a growing emphasis on educational content and peer recommendations.

global financial services market size¹

%

of the world's economy comes from the financial services sector¹

%

of millennials primarily use mobile banking apps²

%

of Gen Z uses P2P payment products³

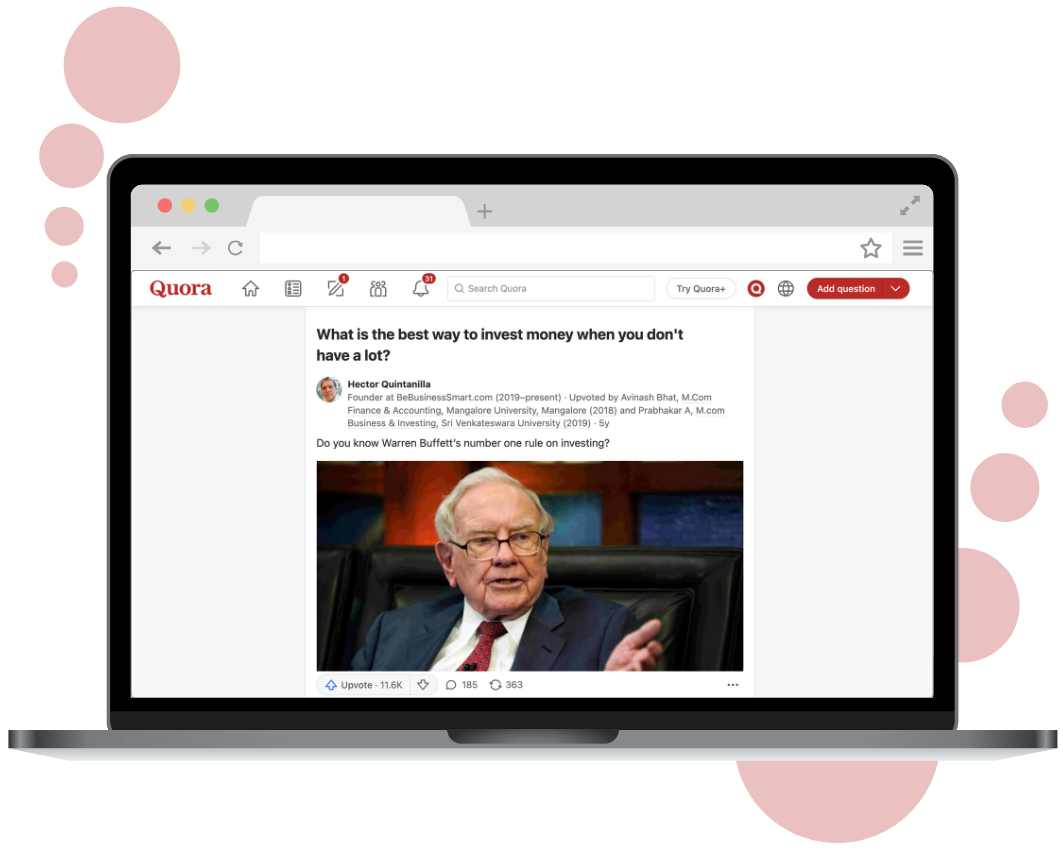

Why financial decision-makers trust Quora

Quora attracts financial professionals, certified advisors, and experienced investors who provide detailed, credible answers. The platform’s format enables specific questions about financial products, investment strategies, and risk management, making it a trusted source for informed financial decisions.

%

use banking, investing, or insurance websites and apps⁵

%

have a credit card⁵

%

are interested in investments⁵

%

sent money online to friends and family in the last month⁵

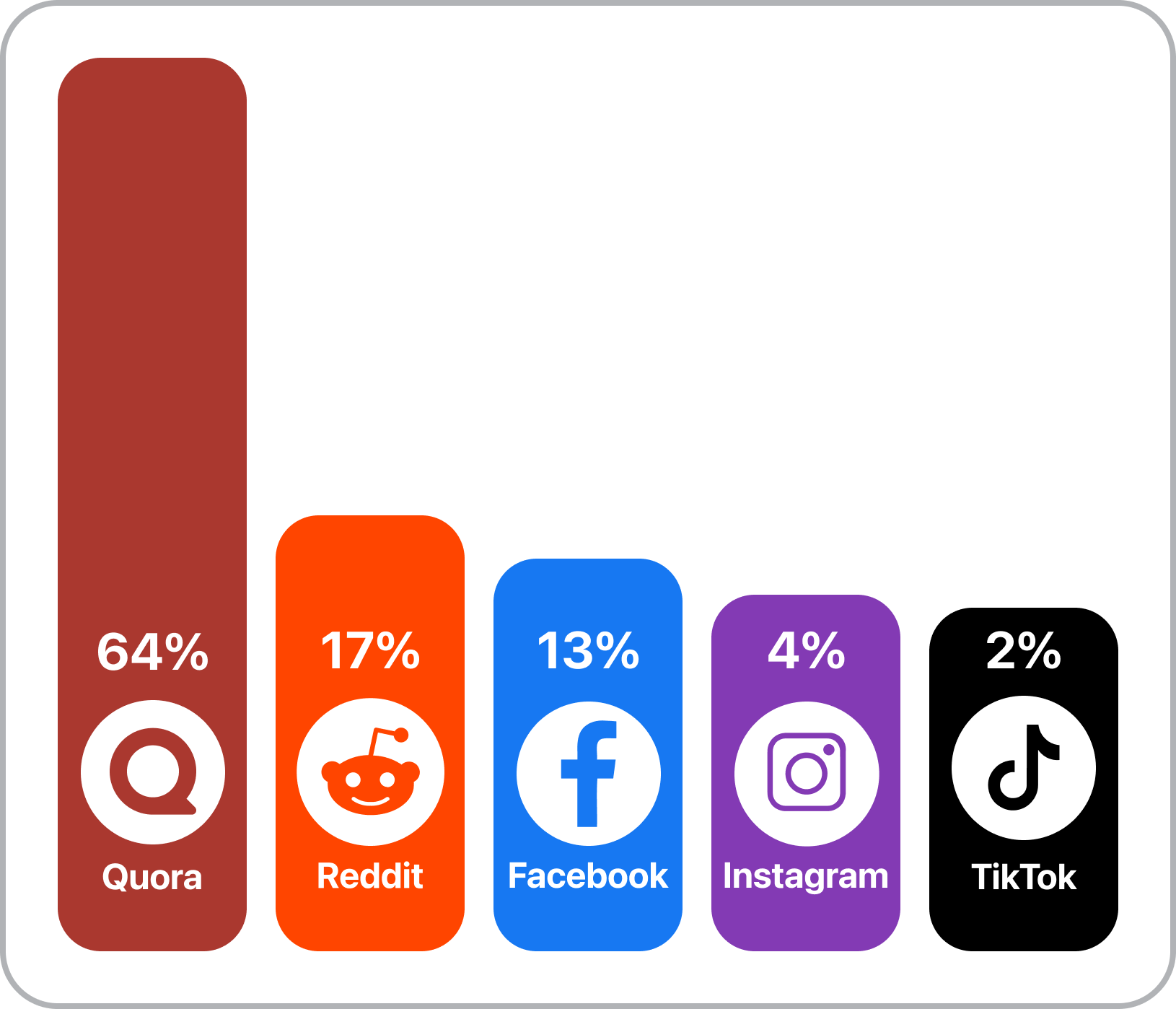

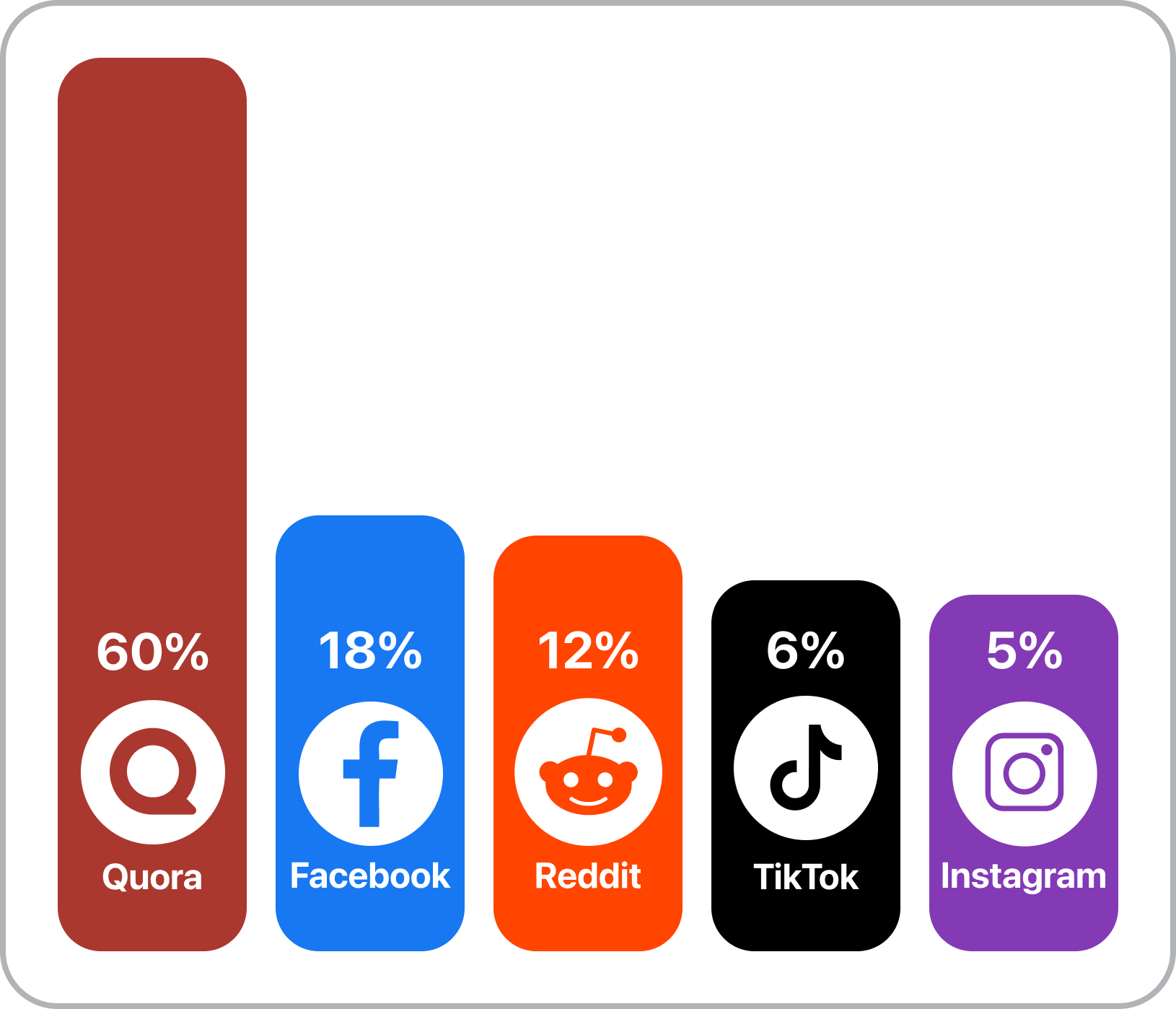

Best for researching a product or service

Best for expert opinions

Best for diverse perspectives

Reach finance audiences at every stage of their journey

Quora offers multiple touchpoints to engage users whether they’re researching investment options, comparing insurance plans, seeking banking solutions, or exploring financial products.

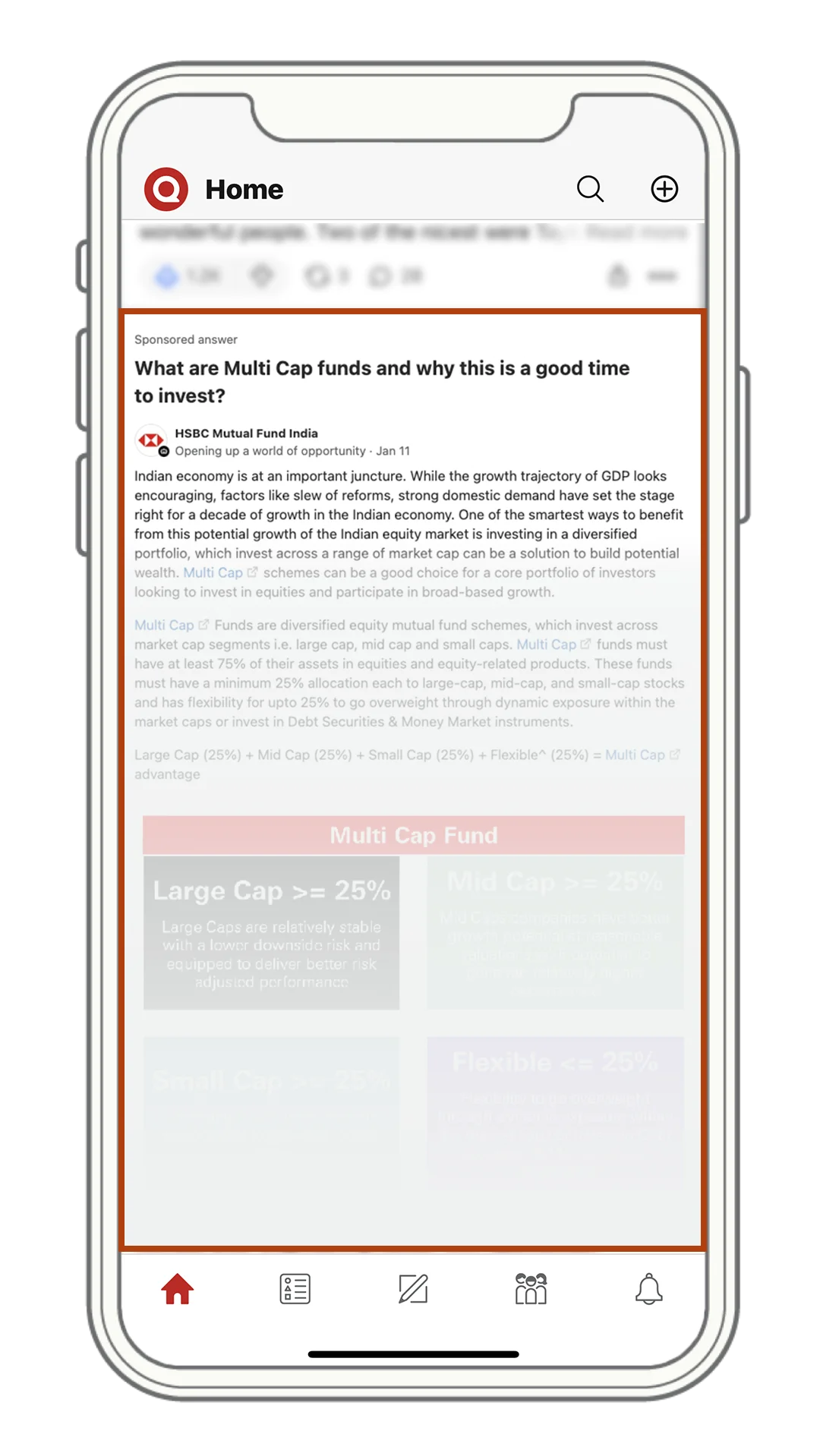

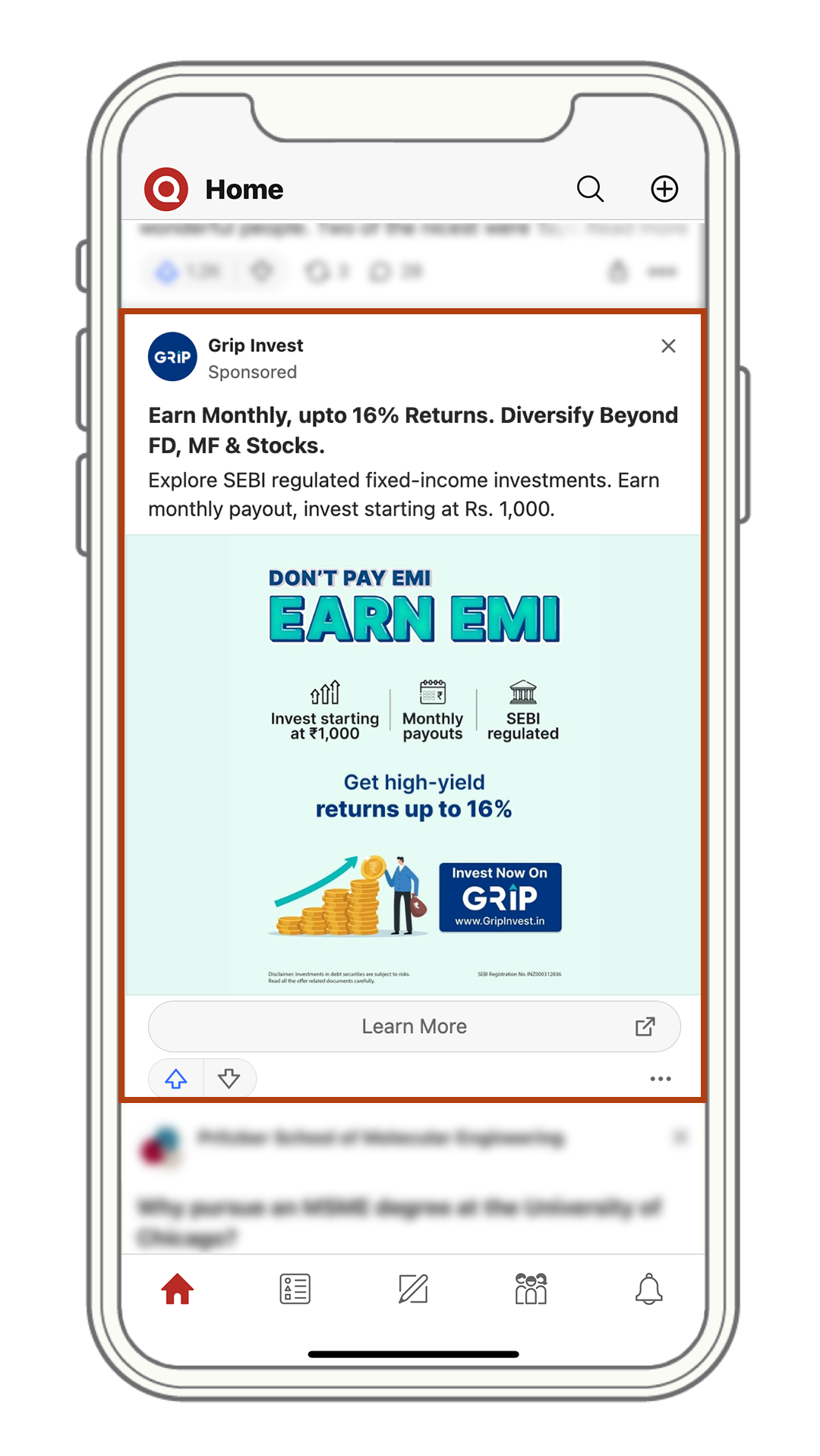

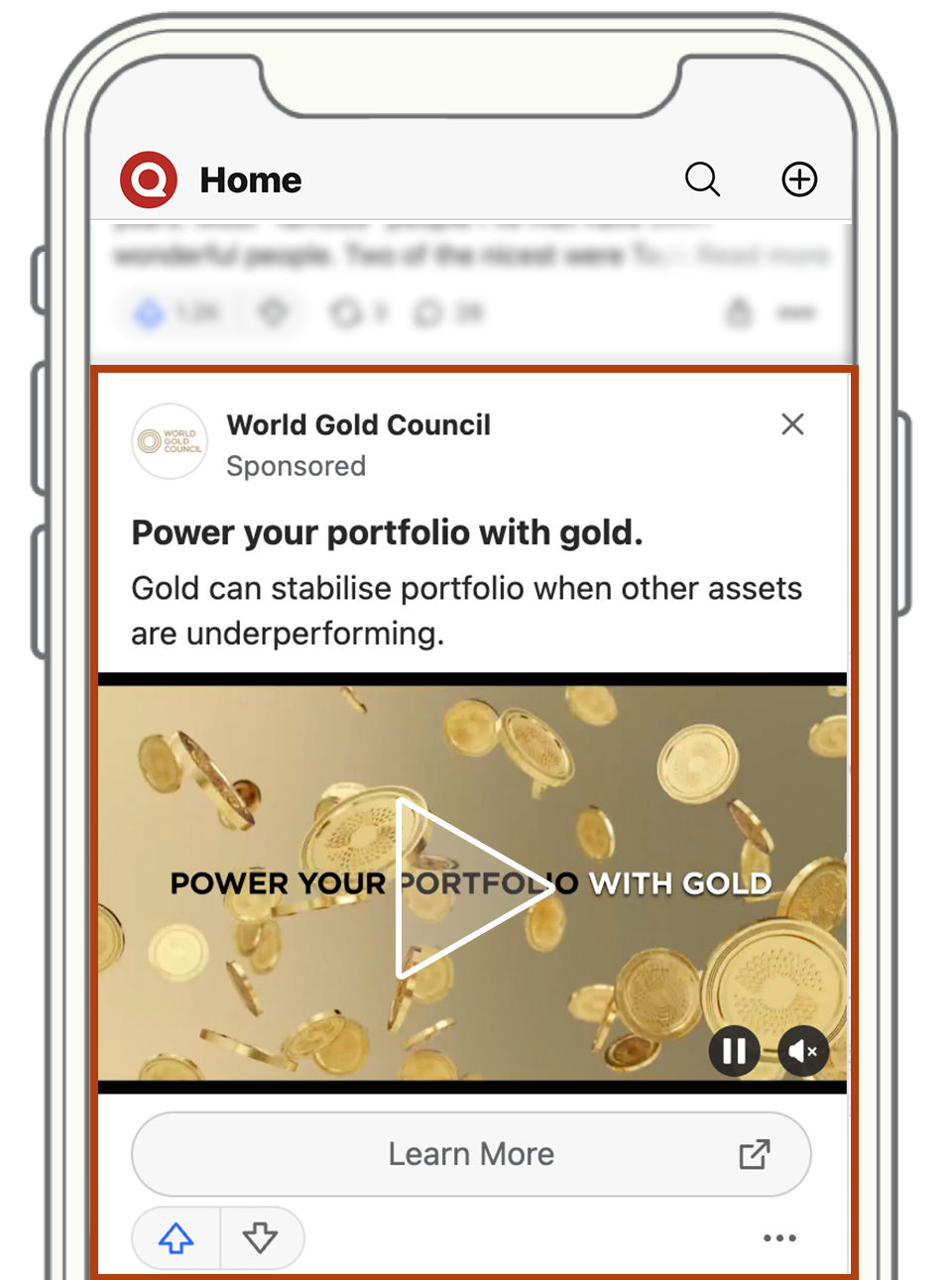

Finance advertising examples

Discover how leading financial brands are leveraging Quora advertising to reach qualified prospects and drive measurable business growth.

Your financial services advertising strategy

Build your financial services campaign on Quora by connecting with consumers throughout their financial decision-making journey, from initial research to final product selection. Whether you’re building trust in financial offerings, driving account applications, or converting high-intent prospects, here’s how to optimize your advertising approach:

|

Lead with educational content that builds trust and credibility. Focus on clear value propositions and social proof while maintaining compliance with financial advertising regulations. Use data visualizations to explain complex concepts. |

|---|

|

Utilize Promoted Answers for detailed product explanations, Text Ads for direct response, and Image Ads to showcase mobile apps or digital banking features. Leverage carousel formats to explain multiple product benefits. |

|---|

|

Layer targeting across financial topics, professional roles, and investment interests. Combine topic targeting with behavioral signals from users researching similar financial products. Use retargeting to nurture high-value prospects. |

|---|

|

Track conversion events like account sign-ups, loan applications, and investment account openings. Measure engagement through content interaction and time on site. Implement comprehensive tracking while maintaining privacy compliance. |

|---|

Ready to reach financial decision-makers on Quora?

Footnotes:

1 Investopedia – Financial Services: Sizing the Sector in the Global Economy

2 PYMTS

3 HTEC – How Gen Z is influencing fintech and banking

4 Based on the GWI Core Q1 2024 survey of 2,013 participating Quora users in the US. Comparisons are to the average internet user aged 16-64 in the US.

5 Based on the GWI Core Q1 2024 survey of 13,597 participating global Quora users, aged 16-64.

6 Quora user survey of Quora feed compared to other platforms