Claiming a piece of the growing insurance pie

Should it come as a surprise that despite India having one of the largest potential insurance markets in the world, it had an insurance penetration of just 4.2% in FY2021 according to IBEF? Perhaps not.

In addition to affordability, a Research Gate article titled ‘Comparison between offline and online distribution practices for the Indian insurance industry’ points out that the biggest constraint insurers face, while using traditional distribution channels, is difficulty reaching their target audience.

But all that’s changing rapidly as digital technology disrupts the dynamics of the industry. Limitations of traditional distribution are evaporating as insurance providers reach out to potential customers through online channels.

Being aware before they get there

Another bottleneck – ‘awareness about the need for insurance’, was alleviated in part by the adverse impact of the pandemic on health and mortality. An May 2022 survey* by insurance aggregator Policybazaar suggests that there is a growing level of willingness to buy insurance, particularly in tier 2 and 3 cities, which are the largest and hitherto most untapped markets for insurance.

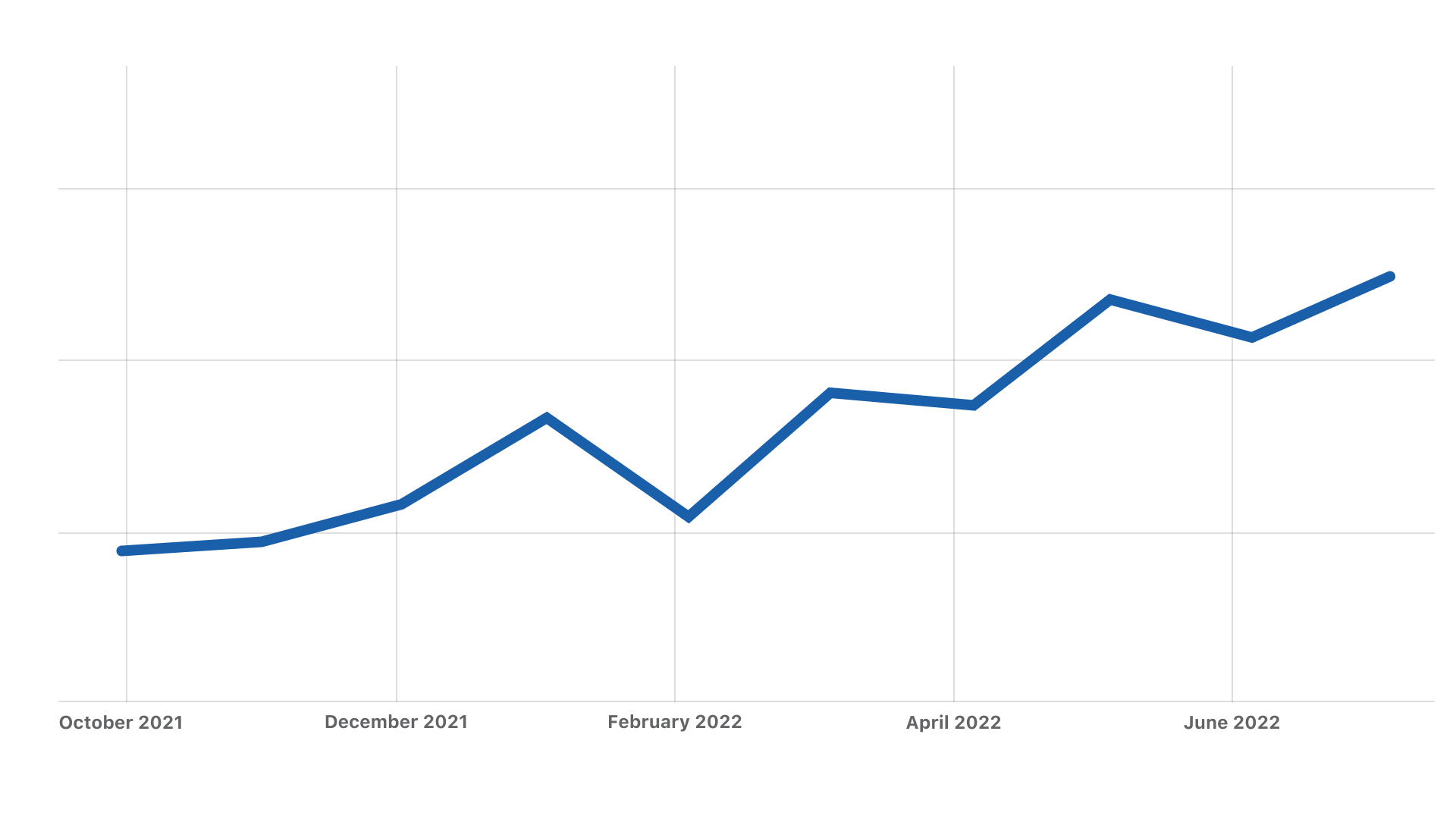

Against this backdrop of shifting trends, insights from Internal Quora Data (October 2021 to July 2022) on the growing online interest in insurance topics suggest a huge opportunity for insurers is emerging.

Views on insurance topics in India

Popular searches have been very sharp and specific, with audiences sharing queries like, “Is investing in an LIC policy a good decision?”, “Which LIC policy is better, LIC Umang or LIC Labh?” and “Is Maxbupa health insurance good in India?” to name a few.

Other popular searches are more general and appear to be testing the waters, with inquiries such as, “What are some good health insurance plans in India?” and “Which is the best term insurance plan in India?”

At the right place with the right answers

So how can insurance providers with a growing digital presence tap into this unfolding opportunity? Being able to respond to high-intent groups in real-time with curated guidance and information is a solid place to start.

Quora audience insights

The GWI Core India survey, 2022 H1, revealed that compared to the average internet user in India, Quora users showed strong intent, the confidence to purchase policies through online channels and a wide interest in coverage themes, amongst other interesting insights.

Marketers in insurance companies can take notes from HDFC Life’s case study of building customer consideration with a full-funnel marketing approach on Quora which resulted in 2 times higher CTR than the industry average and over 20.5 million content views.