This is the latest in our Marketing Thought Leadership series, featuring insights from Ashish Kashyap, Founder & CEO of INDmoney. In this interview, he shared thoughts on the company’s mission to simplify personal finance, emphasizing the importance of accessibility and seamless financial management through their all-in-one SuperMoney App.

INDmoney addresses core user challenges and enabling investments in both Indian and US markets, catering to a growing demand for transparency and personalized solutions. As consumer behavior shifts towards intuitive financial experiences, the platform focuses on real-time insights and user-friendly tools. Their marketing strategy leverages content and community engagement, particularly on platforms like Quora, to educate users. Looking ahead, INDmoney aims to remain innovative and responsive to emerging trends in the fintech landscape.

Vision and Mission

What overarching vision drives INDmoney, and how do you see it shaping the future of personal finance in India?

At INDmoney, our mission is to help every Indian build a financially secure future. We believe investments and managing finances should be simple and accessible, not complicated. That’s why we’re focused on creating a seamless, one-stop platform that empowers users to take control of their finances.

We are committed to delivering value to our customers by addressing their pain points through industry-first product innovations. Whether it’s enabling them to invest in both Indian and US Equity markets from one app to offering features like Instant Withdrawals, providing a seamless view of their stock dividends on a calendar, or tracking their net worth, we are equipping every Indian not just with the tools but also with the confidence to take charge of their financial future; pushing forward the personal finance and fintech adoption in India.

Brand Differentiation

How does INDmoney differentiate itself in the competitive landscape of personal finance apps?

INDmoney was built with first-principles thinking by solving the fundamental challenges users face in managing finances across multiple apps –we offer a highly differentiated and all-in-one SuperMoney App.

The app allows users to track, invest, and grow their wealth effortlessly from one place. Users can track all their finances (including their bank accounts and credit cards), Invest in Indian and US Stocks, F&O, Mutual Funds, NPS; and monitor their portfolio performance along with Net Worth.

We are the market leader in enabling Indians to invest in US stocks. Every day, Indians use products and services from US-based companies—whether through Apple or Windows devices, connecting on social networks like Meta, or streaming content on platforms such as Netflix, Amazon Prime, and Disney. Investing in U.S. markets allows Indian investors to participate in the growth of global tech giants and cutting-edge innovative industries such as AI, semiconductors, and electric vehicles.

Consumer Behavior

What key shifts in consumer behavior have you noticed in the finance sector recently, and how have these influenced your strategies?

In recent times, there has been an increasing demand for transparency, ease of use, and personalized financial solutions. Consumers are no longer just looking for products but also for seamless, intuitive experiences that simplify complex financial decisions. Additionally, younger generations are becoming more financially aware and are actively seeking investment opportunities, including stocks, mutual funds, and international markets, to build their wealth.

These changes have influenced our strategies at INDmoney. We’ve focused on creating a user-friendly platform that brings all financial tools under one roof, enabling consumers to track, invest, and grow their wealth. Our approach centers on delivering seamless experiences, such as providing real-time financial insights and simplifying investments in both Indian and US markets. By staying attuned to these evolving consumer needs, we’re constantly innovating and adapting our products to provide the best possible value to our users.

Marketing Strategy

What marketing strategies have been most effective in establishing INDmoney’s identity and connecting with your audience?

At INDmoney, our marketing strategy focuses on empowering users to take control of their financial journey with ease.

Content marketing is central to our approach. Our focus is on simplifying financial concepts and sharing insights on the Indian and US markets across social media, helping users stay informed. Additionally, on our YouTube channel, we feature podcasts with guests who share real-life personal finance success stories, offering inspiration and practical advice.

By combining educational content, market insights, and success stories, we deliver value to our audience, building trust and empowering them to make informed financial decisions.

Our approach centers on clear, jargon-free but relatable communication to make financial topics approachable and engaging.

Quora Insights

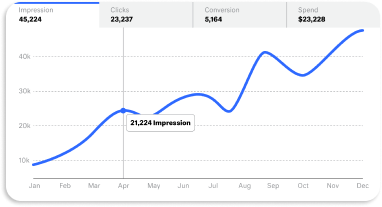

How have you leveraged platforms like Quora to reach your target audience, and what outcomes have you seen from these efforts?

One of today’s challenges is the overwhelming amount of information available online, which can confuse investors, especially those just starting their financial journey. While many are aware of various financial products, they often lack a clear understanding of their benefits and associated risks.

To address this, we have leveraged Quora to engage with the investor community, particularly beginners, by answering questions on personal finance and wealth creation – whether it’s educating the difference in wealth compounding through Direct vs Regular Mutual Funds or the role of the effective risk diversification across financial instruments for balanced portfolio.

Quora offers an ideal community space with unbiased conversations amongst high-intent individuals who engage across a wide array of topics ranging from social, lifestyle, personal finance, investments, etc. Through the platform, we have been able to effectively reach and educate users with simplified financial concepts, empowering them to make informed decisions.

Future Trends

What trends do you foresee impacting the fintech industry, and how is INDmoney preparing to adapt to these changes?

India’s fintech landscape is evolving rapidly fueled by economic growth and rising income levels, geopolitical landscape, and currency fluctuations, and people are seeking effective ways to manage and grow their wealth across Indian and US markets.

At INDmoney, we’re building industry-first product solutions for users to tap into these high-growth investing opportunities with our intuitive financial products. To stay ahead, we adopt the continuous product innovation approach driven by the first-principle thinking of the user’s pain points and solving them for a delightful product experience.

Related Content

Industry Insights

Thought Leadership

Thought Leadership

Book a consultation with a Quora expert

![]()