2025 brings significant tax changes, and Quora users are actively seeking expert guidance. According to recent data, millions of Americans are navigating updated tax provisions and seeking professional advice to maximize their returns.

Inflation adjustments continue to impact tax returns, with the IRS implementing updated tax brackets and an increased standard deduction for 2024 tax returns. More than 147 million monthly unique visitors in the US turn to Quora for expert answers—including consulting trusted professionals for financial guidance during tax season.

Tax season presents an ideal opportunity for financial services advertisers to connect with a wide audience actively seeking tax preparation services and professional guidance.

Hot tax-related topics on Quora

Taxes

879.2K Followers

Income Taxes

440.5K Followers

Tax Policy

298.9K Followers

Tax Law

190.3K Followers

Income Tax Advice

40.5K Followers

Taxes in the US

82.6K Followers

Here’s what people are asking…

What tax experts are saying on Quora:

Be sure you discuss your salary structure and changes in that with tax consultant.

As long as the accountant is qualified and does accurate work, it will somewhat decrease your chances of being audited.

Some people use the term ‘salary’ to refer to all of an employee’s compensation. If that’s the case, then a bonus would be included in that ‘salary.’

There are ‘tax laws and loopholes’ for every income group.

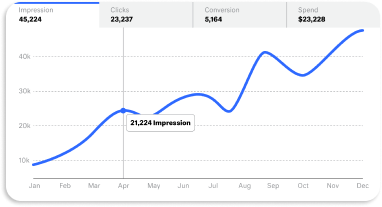

Monthly Unique Visitors

Topics

%

have an undergraduate degree or higher¹

%

report a household income of >$85K¹

%

trust online financial tools for advice²

%

trust certified financial advisors²

%

trust websites/blog posts about finances²

%

are interested in finance and the economy²

%

invest in stocks and shares²

%

have investments worth more than $100K²

Related Content

Industry Insights

Industry Insights

Seasonal Insights

Book a consultation with a Quora expert

²Based on the GWI Core Q1 2023 to Q3 2023 surveys of participating Quora users in the US. Comparisons are to the average internet user in the US surveyed by GWI.